Condo Insurance in and around Morgan Hill

Townhome owners of Morgan Hill, State Farm has you covered.

Protect your condo the smart way

- Morgan Hill

- San Jose

- Gilroy

- San Martin

- Santa Clara County

- California

- The Bay Area

- Arizona

- Nevada

Home Is Where Your Condo Is

Because your home is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or weight of ice. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Townhome owners of Morgan Hill, State Farm has you covered.

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with fantastic coverage that's right for you. State Farm agent Kevin Bailey can help you discover all the options, from a Personal Price Plan®, replacement costs to liability.

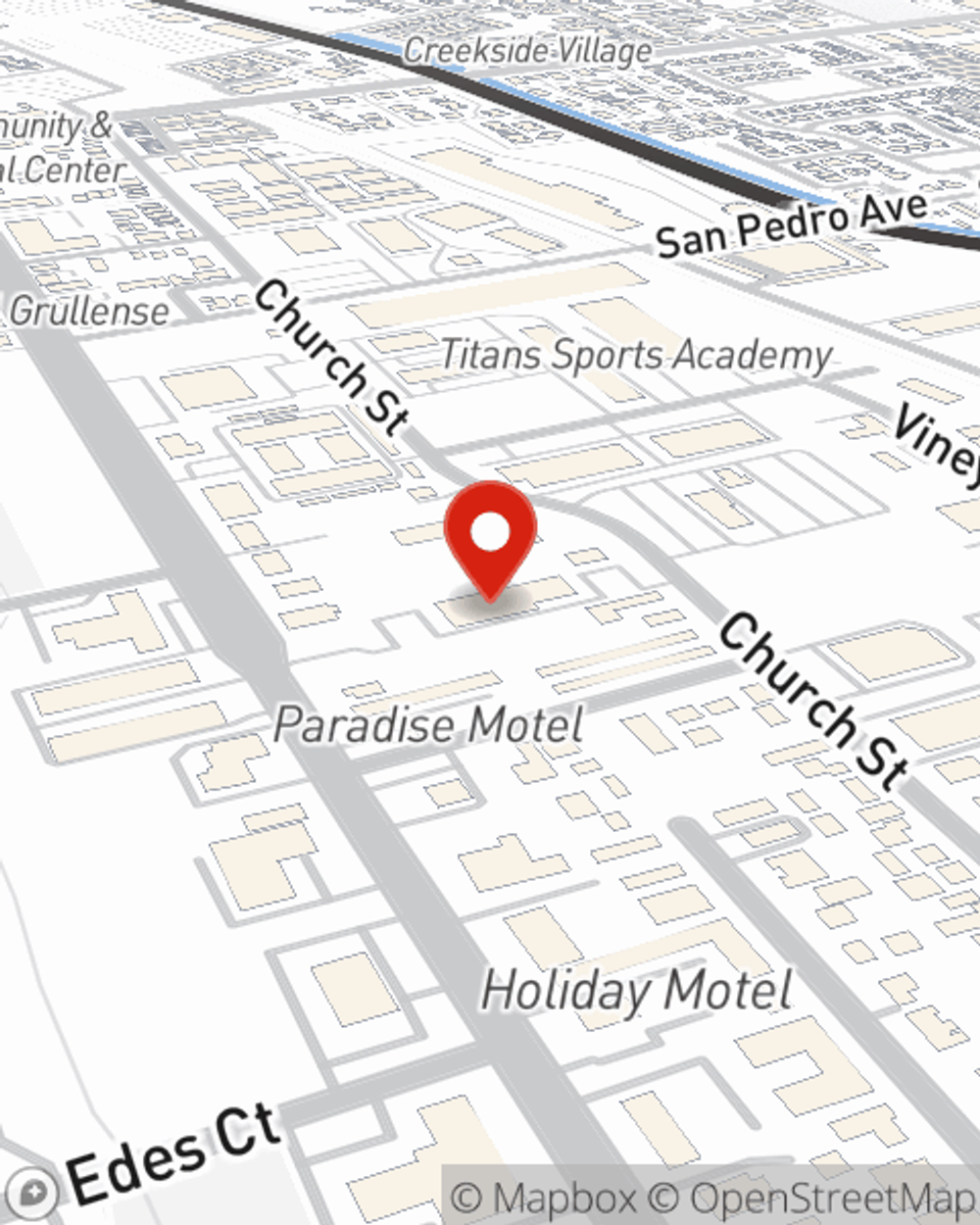

Visit State Farm Agent Kevin Bailey today to explore how one of the leading providers of condominium unitowners insurance can help protect your townhome here in Morgan Hill, CA.

Have More Questions About Condo Unitowners Insurance?

Call Kevin at (408) 612-4262 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Kevin Bailey

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.